UK’s clothing, footwear and accessories online store: NEXT PLC -vs- Other competitors

http://ilokabenneth.blogspot.com/2017/03/uks-clothing-footwear-and-accessories.html

Author: Iloka Benneth Chiemelie

Published: 28th March 2017

Published: 28th March 2017

Industry analysis

No doubt, the UK clothing, footwear and accessories

marketing is giant in terms of value as it is presently estimated to be worth

over £50 billion, with growth projection for 2015 to 2020 being a forecasted

increase of 4.5% per annum (PWC, 2016). This leave an open and vast

opportunities for established brands such as Next to capitalize on this

financial fortunes and enhance their performance. In general, the industry has

witnessed a steady growth between to 2009 to 2015, with the menswear and

womenswear the most prominent performers (PWC, 2016). It is also forecasted that menswear will

outgrow other categories as a result of huge investments made by the industry

players within this category. Incremental growth is also expected in the

womenswear category and this will be driven by niche ranges that include:

plus-size, petite, tall and maternity wears (PWC, 2016).

The online channel is expected to continue reaping havoc on

the conventional stores’ market share with a forecasted increase of 29% (PWC,

2016) of the industry’s market share by 2020 as demonstrated in the figure

below. Major players in the industry determine this shift at the moment and

much changes are not expected, however as new entrants and smaller once verge

for a competitive edge, it is expected that the online store will witness a higher

boom in the near future (PWC, 2016).

Figure 1: UK’s clothing, footwear and accessories online

store to account for 29% of industry by 2020

Source as adapted from: verdict (2015) (as quoted in PWC,

2016).

The rise in market growth is expected to be powered by an

increasing volume of disposal income, improved consumers’ confidence and an increase

in consumer sub-segments (PWC, 2016). Essentially, this will be supported by

deflation of clothing prices, a shift towards experience based expenditure, and

innovation by the clothing retailers (PWC, 2016).

Critical discussion

of the NEXT’s competitive advantage among the direct competitors

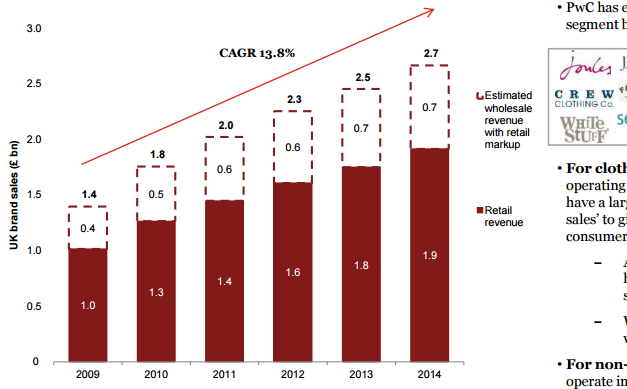

NEXT has successfully positioned itself as a premium brand

and it does come with a competitive edge. This is as the UK “premium lifestyle”

clothing market has been estimated to worth over £2.7 billion and expected to

continue it surge as illustrated in the figure below. This surge is projected

to be between 6.6% per annum between 2014 and 2020 (PWC, 2016). Thus, this presents the company with an

amazing competitive edge over its competitors following established market

positioning and brand image.

Figure 2: Estimated growth of

UK’s premium clothing, footwears and accessories

Source as adapted from: PWC (2016)

The company has a reliable and sustainable online sales

platform and this enhances overall competitive advantage. This is most special

with the forecasted increased on online sales as it will help the company

towards it’s’ push for sustainability.

Probable industry

scenario facing NEXT

The projected increase in market growth is expected to be

driven mainly by inflation due to high volume. As companies in the industry

fight for competitive edge, they will likely reduce their prices and gain

higher order in the process – forcing price competition within the industry;

which will eventually result to n even lesser prices as companies fight to sale

off huge stock deposits. This is expected from 2018 (PWC, 2016) and it is a big

issue for NEXT as it will have direct negative impact on their financial

performance when compared with previous years.

Figure 2: Market growth will be driven mainly by inflation

Source as adapted from: Verdict (2015) (as quoted in PWC,

2016).

The UK street retailers are also looking to innovate their

position in search of new sources of growth. Such innovations have seen these

retailers extent into new categories, opening new fascia, developing new

concepts, extending new channels and forming new partnerships (PWC, 2016). All

these innovations does pose huge competitive threat to NEXT as it implies that

the company will have to battle these new innovations in order to force growth

within its sphere.

In recent months, arguments have also emerged that “BREXIT”

will have direct impact on UK’s business as successful implementation will

block all forms of free movement from Euro zone members, removes all forms of

free movement of goods and reduced tariffs when exporting within the Euro zone,

and also increase price value of products (as the pounds, not the euro will

become official trade money) (Broad, 2016). Thus, these issues will result to

competitors (at least with the Euro zone) being offered higher competitive

advantage and it is something that NEXT needs to look into.

Reference

PWC (2016). The UK “premium lifestyle” clothing, footwear

and accessories market. Available at: https://www.pwc.co.uk/assets/pdf/uk-premium-lifestyle-market.pdf

[Accessed on: 14th August 2016).

Broad, M. (2016). What impact would Grexit have on the UK? BBC News. Available at: http://www.bbc.com/news/business-33165580

[Accessed on: 14th August 2016).

Location:

California, USA