Affordability of tertiary education in Malaysia

https://ilokabenneth.blogspot.com/2013/12/affordability-of-tertiary-education-in.html

Author: Iloka Benneth Chiemelie

Published: 25/12/2013

1 INTRODUCTION

Published: 25/12/2013

1 INTRODUCTION

From

the works of Schultz (1971), Sakamota& Powers

(1995), Psacharopoulos&Woodhall (1997), it has been stated that the

theoretical framework responsible for adoption of education as a means of

development is the human capital theory. In this theory, the provision of

formal education is seen as a productive investment in human capital (Olaniyan&Okemakinde, 2008). There is a general

consensus amongst economists that human capital is vital for increased economic

growth and labour productivity in a country. Such investments in human capital

include initial costs such as tuition fees and earnings forgone by the

individual wile at school, and firms as well as the country’s hope to obtain

improved productivity in the future from the individual with higher earnings.

There

is a growth on new theories that have emerged to identify how government and

private sector investments can be used to increase economic growth through

increased growth in human capital, physical capital, technological competencies

and intellectual capital. In accordance with the growth theory, the excess of

education is the necessary ingredient for sustainable economic growth (Blundell, R., Dearden, L., Goodman, A& Reed, H, 2000).

This is because, human capital is capable of creating positive effects on the

long-term growth of an economy (Rebelo, 1991), and

Barro (1991) and Barro& Lee (1994) supported this idea by stating

that economic growth and productivity in the global environment is positively

influenced by human capital growth.

As

such, it can be stated that education should be the main priority for the

Malaysian government as it will help to enhance productivity and ensure

sustainable growth in the country’s economy. However, the question is how the

education system should be finance. In Malaysia, people have different options

of how to finance their education such as personal income, sponsorship, loan or

scholarship.

Therefore,

the purpose of this paper is to determine the best amongst scholarship and

study loan is. In order to achieve this task, literatures from past theories

will be used to support individual opinion and debate. The question will be

answered in terms of the financial system’s efficiency and equity level. Thus,

this paper is divided into four sections. The first section is the literature

review on high educations and means of financing them in Malaysia. The second

section is a comparative debate between study loans and scholarship. The third

section illustrates the cost-recovery mechanism for loans in Malaysia, while

the final section is recommendation on the best approach for financing higher

education in Malaysia.

2 LITERATURE REVIEW

2.1 ROLE OF TERTIARY

EDUCATION AND COST

The

main role of tertiary education is to meet a nation’s human resource needs for

socioeconomic development (Lindong, 2007; Aafaq, 2007).

Higher education which is also known as tertiary education is defined as a

course that leads to an award of a degree, and post graduate diplomas (Gupta, 2008; Middlehurst&Woodfield, 2004, p. 8).

Over the last two decades, the number of students in higher institutions across

the world has more than doubled from 40 million in 1975 to more than 80 million

in 1995, and this figure is expected to be way above 50 million by 2025 (TheWorld Bank, 2000). The trend for enhanced human

capital is most common in certain developing countries of South East Asia and

Latin America. Malaysian is a South East Asia country. Marjik

(2003) also reported that as a result of the increased demand for high

education, some countries are not able to meet the demand for higher education.

In

Malaysia, Higher education is still remains an important development factor (Samuel J.,Srikamaladevi M., Saravanan M., &Murali R., 2011).

It is important that the demand for higher education is satisfied for all

Malaysians (Yahaya& Abdullah, 2003). In

recognition of this need, the government of Malaysia detailed out the

challenged it is facing in relation to providing adequate higher education in

the Seventh and Eight Malaysia Master Plan (Samuel J.,Srikamaladevi

M., Saravanan M., &Murali R., 2011). The first issue identified by

the government was how to increase access and maintain standards for higher

education (UNESCO, 2006). This is because there

have been an increase in enrolment in the public tertiary education

institutions since 2000.

As

a result of the increase in demand for higher education, it is now difficult

for any country to meet the dreams of students and their sponsoring families (Karmokolias& Maas, 1997). This increase in demand

now means that public universities in both developed and developing nations are

either unwilling or unable to accommodate all students that seem admissions per

annum (Patrinos, 2000). This issue has

effectively created crisis in affordability of higher education (Morgan-Klein & Murphy, 2002, p. 64). As such, access

and affordability of higher education is still a diverse issue and challenge in

Malaysian higher education (Hassan, 2002). Many

students in Malaysia find it difficult to get admitted into public institutions

because of the limited spaces available for admission (Samuel

J.,Srikamaladevi M., Saravanan M., &Murali R., 2011).

At

this point, the role for private institutions to increase access to tertiary

education must be recognized (UNESCO, 2006; Altbach,

2004; Hauptman, 2003; Morgan-Klein & Murphy, 2002). Private higher

education is characterized by the application of marketing principles in

management and operations of these institutions, which may or may not be

accorded any financial support by the government. As such, the objectives and

functioning of private institutions is likely to be different from public

institutions (Gupta, 2008). Presently, 30

percent of the students aged 17-23 enrol for tertiary education in Malaysia and

the government has set the enrolment rate to be 40 percent as of 2010.

Additionally, the Ministry of Higher Education has also set the target to be

only 1.6 million open places in tertiary education as of 2010 (Samuel J.,Srikamaladevi M., Saravanan M., &Murali R., 2011).

However, private institutions are still relatively higher than public

institutions, and this should not be confused as an escape route for students

to gain higher education. In that case, the issue of affordability is of

education is still lingering around. This issue will be tackled in Malaysian

context below.

2.2 THE AFFORDABILITY

OF EDUCATION IN MALAYSIA

Samuel J.,Srikamaladevi M., Saravanan M., &Murali R(2011)

there are little studies on the affordability of tertiary education in

Malaysia. However, there are many studies on related tertiary education issues

in Malaysia. The National Higher Education Research Institute (NHERI) is the

body responsible for undertaking higher education policy researches for the

Malaysian Ministry of Higher Education. The body was established in 1997, and

it has carried out more than 40 different studies on higher education, but only

two studies was carried out on the issue of affordability of higher education

and none of them was direct on the issue. Instead, indirect questions such as

what should be the cost of higher education were asked.

No

matter the case, the above arguments show that understanding the cost of high

education is necessary because it will help to developed strategies to make

education accessible and in the other hand, increase productivity and economic

growth in the country. In response to the importance of accessible higher

education, both scholarships and study loans are issued to students to

undertake their higher education. However, the question is whether study loan as

its becoming more popular than scholarships is in essence more efficient and

effective. This question will then be addressed below.

2.3 SCHOLARSHIP OR

STUDY LOAN? WHICH ONE IS BETTER?

In

many countries, financing higher education has been possible through numerous

cost sharing methods such as student loans and scholarships. The student loans

are beginning to replace the traditional trend of grants and scholarships. As Alphonse (2012) argued, the importance of loan takes

three main trends. The first is that in countries where student loans have been

explored for long period of time, the demand for loan support has been

increasing with a subsequent increase in school fees and living expenses in the

country. Although there might be individual differences, most of the students

in these countries such as Malaysia get a larger sponsorship of their education

through loan.

The

second trend is a product of limited public fund and growing need for private

returns on higher education. As a result, student loans are being introduced in

countries where they were not previously adopted. The third trend is the use of

student loans to replace grants and scholarships as is experienced in Malaysia.

Understanding the third trend is the main purpose of this paper.

However,

the idea of borrowing for learning is in contrast with the traditional system

of grants and scholarship; and has raised numerous arguments amongst economists

of education (Woodhall, 1987a and b; Woodhall&

Barr, 1989). For instance, Barr & Crawford

(2005) is of the notion that the provision of student loans to replace

scholarship is better in terms of equity and efficiency. This paper will be in

support of Bar & Crawford’s (2005) idea that

student loan should be made to replace scholarship because:

2.3.1 EQUITY ARGUMENT

Equity

in essence can be defined as the degree of fairness and justice. In this

contest, it will be viewed as the extent in which student loan can be

considered as being fairer than scholarships in financing higher education.

Basing the argument on the word “fair”, it can easily be stated without further

debate that student loan is fairer than scholarship because it offers equal

opportunity to everybody, repayment is easy, and it covers all courses till

graduation.

In

Malaysia, student loan schemes such as MARA loan and PTPN offer students equal

opportunity to obtain higher education. This is because; any qualified

candidate can apply for the loan and use it to sponsor his or her higher

education. This is better than scholarship because scholarship does not offer

equality opportunities to everybody, but instead focuses on specially gifted

and talented students, or a set of people within certain demographic dispensation

such as (race, state or social status of their family). This is totally unfair

as some of the students who might actually be gifted cannot easily be noticed

in such a scheme. Student loan solves this problem by giving every student the

opportunity to further their education.

Secondly,

student loans incur low interest and sometimes no interest rate. In

government’s bid to subsidize education, student loans incur a relatively low

interest rate and in some countries there is no interest rate on student loans.

Considering the fact that it offers equal opportunity for all qualified

applicant, this becomes an added advantage as students can be less worried

about high interest rates that are normally associated with other forms of

loan. In essence, student loan gives another hard blow to scholarship as a

means of financing higher education in the sense that students can be sure that

interest rates won’t be a hindering factor to such approach.

The

last but not the least for this debate is the fact that loans cover all courses

throughout the students’ course of study. Unlike loans, scholarships can be

offered to cover only certain subjects or for certain semesters or with elapse

of the allocated fund depending on the contractual agreement. Student loans are

far better than scholarships because they cover all the courses and as such

guarantee students of gaining higher education. The limitation of scholarship

in this area makes it less significant as a means of sponsoring higher

education because if a student doesn’t have the necessary funds to cover up for

the courses or semesters not covered by the scholarship, the student will

eventually end up not completing the course and the gained skills will not be

regarded in the society because there is no certificate to prove the student’s

competency in that field.

From

the above arguments, it can be seen that the option of adopting student loan as

the main source for funding higher education in place of the traditional grants

and scholarship scheme is better because it makes education highly accessible

to all qualified individuals in the society. Therefore, there should be little

equity debate on this issue because student loan is better than scholarship in

the sense that it’s for all members of the society, incurs little or no

interest rate and covers the whole courses taken by the beneficially.

2.3.2 EFFICIENCY

ARGUMENT

Efficiency

on the other hand is considered as the degree to which something is used for

the actual purpose it is meant to be used. In the literature review, it was

stated that the Malaysian government is currently facing the challenges of how

to handle the high number of people desiring to enrol into higher institutions,

and that education is necessary for maintaining the economic growth and

productivity of a country. In this case, efficiency is described as the rate to

which the loan (monetary investments) issued by the government is being used

for the purpose of education.

Unlike

scholarships and grants, loans are usually issued by financial institutions such

as banks that closely monitor the extent to which the money is being used for

the purpose it is meant for. In the case of student loan in Malaysia, they are

issued by banks and paid directly into the school account to cover the students

overall courses. Since the transaction is between the school and the bank,

there is no doubt to the fact that student loans are being efficiently

utilized. The only obligation the beneficially has is to attend classes and

complete the courses.

Secondly,

repayment is done between the beneficially and the bank after graduation. Once

the beneficially has a job, the loan will then be paid back gradually based on

agreed terms and conditions. There are also some other features such as

government subsidy designed to ensure full payment in the case where the

student finds it difficult to get job after studies or dies before the

completion or after studies without repaying the loan. Therefore, such program

by the government means that financial institutions and other agencies are willing

to help finance higher education of qualified people in the society.

Finally,

another area where loans are more efficient than scholarship is the ease at

which it can be obtained. Student loans are easily obtainable in Malaysia by

simple application than scholarships which require rigorous process and tests.

In order to get access to student loan, all the applicant needs to do is go to

the nearest loan office, fill out the form with his details and the details of

the school and wait for approval. This is fast, easy and more convenient as the

loan offices are usually assessable. Therefore, it can be seen from this

argument that loans are more efficient than scholarship in the sense that

scholarship lacks the qualities of loans as discussed above.

From

the equity and efficiency debate presented in this paper, it is hoped that

people will now become clearer about the reason why this paper adopts the

notion that student loan should replace scholarship as a means of fundinghigher

education because students are easily accessible, available for all qualified

people in the society, subsidized by the government, covers the total duration

of a course and easy to be applied for.

2.4 SUPPORTS FROM

INTERNATIONAL EXPERIENCE

Maureen (2004) in review of his

international experiences after helping governments across the globe to draft

means for making education accessing present favourable argument for loans

based on both efficiency and equity. The efficiency argument is of the notion that

loans are better than grants because:

1. They reduce demands on

government budget and on taxpayers – this is true

because the availability of loan means that the government doesn’t need to make

extra budgeting for financial higher education, and taxes will not be increased

in order to meet such demands.

2. Provide additional

resourced that will be used to finance the expansion of higher education and

widen access to education – this is also true

because the availability of loan as discussed in above is done through bank to

school policy, and the schools can use the money to broaden access to education

and develop their system to ensure a more efficient academics unit.

3. Increase students’

innovation by making them aware of the cost of higher education, and helping

them to evaluate the cost and associated benefits of such loans in relation to

repayment – just like the two arguments above,

this is true because during the process of issuing the loan, the students are

well briefed on the terms and conditions for repayment, and as such, students

who think they can’t meet such terms will seek innovative ways of paying their

school fees such as studying part-time and working at the same time.

On

the other hand, equity arguments as also presented by Maureen

(2004) based on international experience and comparison focused on costs

and benefits, and is option the notion that since most of the university

graduates can expect a substantially higher income because of their education,

students who are benefits of higher than average earning should not be

subsidized by taxpayers with an average or below average earning. This is

justifiable because it will be unfair for employees who earn the same or less

than the students working part-time to help in subsidizing the school fees of

these students.

The

debate on equity of loan as a means of funding education has found interest

from World Bank and it is the bases of its three conclusions that:

1. The

great share of public resources is awarded to higher level of educations, and

less to the lower level of education (World Bank, 1986,

p. 10).

2. Since

higher education systems are being financed by the entire population and yet

made available to only a small minority of the population, such finance has a

regressive fiscal impact (World Bank, 1994, p. 23).

3. The

issue of cost-sharing cannot be solved equitably without a functioning student

loan program that is designed to make funds available for all students who need

to borrow in order to finance their education, and also a scholarship programs

that guarantees necessary financial support to academically qualified poor

students in the society (World Bank, 1994, pp. 46–47,

50).

While

the efficiency argument in accordance to international experience can be fully

supported, the equity argument presents room for debate. The debate of whether

taxpayers should subsidize the loan of students who earn relatively higher than

them or the same as them. The debate is in proposition that they should help in

such subsidy act. This is based on the growth theory, in which it is expected

that the students will one day get a job and also help in subsidizing the

student loans of other people and the cycle continues infinitely. Therefore,

such an argument should not be the reason why provision for student loan should

be aborted in place of grants because the process is continuous and those being

helped today will be helping others tomorrow in an infinite process of

subsiding education.

The

second debate is based on World Bank’s statement that for cost-sharing to be

solved, there should be a functioning student loan program that makes funds

available for all students who wants to borrow in order to finance their

education, and also a scholarship program that guarantees necessary financial

support to academically qualified students in the society. This statement is

incomplete because; the word “borrow” is already applicable in cases where the

student is academically qualified (finished high school) but doesn’t have fund

to continue higher education. Additionally, while loan is broad and open to the

whole society, scholarships are limited to specific number of people and

specific periods in time. As such, the government can invest the scholarship

funds into subsidizing education through loan and as such increasing the number

of people going for higher education. On the other hand, the government can

also use the money to address World Bank’s first issue that loans focuses on

higher education by investing the funds into free education in lower education

systems. As such, it can be seen that notwithstanding the arguments presented

by World Bank, loan is still the right solution for financing higher education

and making education highly accessible.

3 LOANS AS

COST-RECOVERY MECHANISM FOR FINANCING EDUCATION IN MALAYSIA

In

order to maintain sustainability of the academic system in relation to

providing student loans for future generation, the present generation have to

repay all money borrowed. Cost-recovery mechanism in this case can be defined

as the ways in which sustainability can be ensured by make sure that all

borrowed money are returned by the borrowers.

In

this paper, PTPTN loan scheme will be evaluated. In accordance with PTPTN (2013), the repayment for student loan starts 6

months after graduation and the repayment is in as per student’s level of

education as illustrated in the table below.

Table

(1): PTPTN Education Loan repayment before 2003

However,

the repayment mechanism was changed from 2004 and based on the education loan /

financing amount as illustrated in table 2 below.

Table

(2): Amount and D

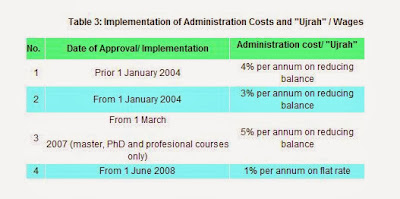

The

repayment period for recipients who receive offer of loan is converted from 3%

to “Ujrah” 1% education financing based on the balance of the repayment period

according to original agreement. This implies that if the student is not able

to fully pay up within the expected repayment period, there is an additional 1%

plus initial interest on outstanding bills. This is as illustrated in the table

3 below.

Table (3)

Administration costs and “Ujrah” / Wages

In

order to ensure full repayment, the government of Malaysia has enacted numerous

measures such as 20% discount for graduates who repay all their loans within

one year, 10% discount per annum for borrowers who consistently make repayment

within schedule. Refsa.org (2013) stated that the federal government is currently

able to collect only 50% of the dues owned by borrowers per annum. The issues

behind such as highlighted by Refa.org (2013) are

that: unemployment is high and graduates have other financial constraints such

as car and housing loans; and data sitting in PTPTN’s loan management system is

severely outdated and this have resulted in the government’s inability to fully

trace the students who benefited much of the RM45.41 billion loans approved by

PTPTN. Additionally, it is thought that by offering the discount, the

government is actually rewarding those who have the means to repay but chose

not to, and this argument is supported by the fact that since the reward scheme

was introduced, 2962 borrowers have actually come to repay their student loans

in full within a month (Refa.org, 2013).

From

the above argument, it can be stated that the current cost-recovery mechanism

adopted by the government is ineffective and doesn’t guarantee sustainability

for the future generation. The reason behind such statement is because:

3.1 The government

can’t trace much of the people benefiting from the loan

– it is poor to note that a country like Malaysia does not have adequate and

advanced facilities to regulate the student loan issuance and the people whom

they are being loaned to, as Refa.org in the statement above made it known that

the government can’t trace much of the students benefiting from the 45.41

billion Ringgit loan. If that is the

case, much of the money spent cannot be recovered and it will put pressure on

both the government and taxpayers, which will subsequently result in the

abolishment or the program or reduction in budget. In essence, the access to

education will be affected negatively.

3.2 Discount for loan

payers and only 50% recovery rare – these two

issues as discovered above creates insufficiency in the recovery system as the

discount will mean that borrowers will not eventually pay up to the amount they

borrowed because they have 10% discount for successful payment within the

stipulated time. Additionally, the 50% recovery rate means that about half of

the money invested by the government will not eventually get recovered in time

or might even never get recovered. Thus, this creates a big issue of

sustainability as under recovery of the associated costs will mean that the

future generations will have little to survive with in terms of student loan

for financing their education.

From

the two supports above, it can be seen that a change in the cost-recovery

mechanism adopted by the Malaysian government is important in order to

guarantee a sustainable future of financing higher education in the country.

This is important as it will help in maintaining and improving the human

capital disposal in the country as the current mechanism is not built to

guarantee such.

4 PROPOSED FORM OF

STUDENT FINANCIAL SUPPORT FOR TERTIARY EDUCATION IN MALAYSIA

From

the equity and efficiency argument, numerous factors were determined to be in

favour of adopting loan instead of scholarship as a means of financing higher

education in Malaysia. These factors were based on both personal review and

international experience review. Thus, student loan is the proposed form of

financial support for tertiary education in Malaysia. This is because:

1. Student

loans cover all courses to be undertaken by the student instead of the part

covering mechanism of some scholarships.

2. Students

loans are easy to obtain by just moving to the nearest offices and signing up

for it, which is better than the rigorous process and tests associated with

obtaining scholarship.

3. Student

loans can be obtained by any qualified individual, which is better than

scholarships designed to cover the financial support for only gifted

individuals.

4. Student

loan reduces pressure on government budget and taxpayers because students are

sourcing their education themselves.

5. Student

loan makes the students innovative as they are made aware of the terms and

conditions associated with such offers and students who are not capable of

meeting such terms or don’t like the terms can find other innovative ways of

sourcing their school fees such as working part-time while studying.

6. Student

loan also provides the financial support for expanding the education system and

making education accessible because with student loan, the number of enrolment

is highly increase and the money generated can be used for providing a more

effective and efficient academic system that is highly accessible.

The

current cost-recovery mechanism adopted by the Malaysian government in the case

of PTPTN loan as discussed above is effective and doesn’t guarantee

sustainability of the system. Therefore, it is recommended that the government

should ensure sustainability by improving their recording system and security

measure to ensure that all students benefiting from the loan are traceable.

Additionally, the creation of job opportunity is also important to help provide

graduates with the necessary funds to repay their debts. The third

recommendation is that the Malaysian government should review the reward

measures as it puts pressure on government budget and taxpayers.

5 CONCLUSION

It

must be acknowledged that this paper has been able to meet the objective of

debating on whether student loan is more efficient and effective than the

traditional method of scholarships and grants, evaluating the performance of

cost-recovery mechanism adopted for any student loan in Malaysia and its effect

in sustainability of the academic system, and proposing the form of support for

financing higher education in Malaysia.

In

the course of meeting these objectives, the paper has been successful in discussing

the affordability of tertiary education in both Malaysian context and on other

countries across the globe, as well as Malaysian and global governments’

efforts to make education accessible in their countries. One of the most

significant discoveries is that human capital is essential for maintaining

productivity and increased economic growth in a system, making the support for

higher education by the government very important.

In

this paper, the argument was vividly in the favour of student loan as scholarship

was associated with numerous limitations while student loan offered those

features neglected by scholarship. However, it was also discovered that the

current cost-recovery mechanism adopted by the Malaysian government does not

guarantee sustainability because it has numerous weaknesses such as outdated

data recording system, inability to trace all students benefiting from the

loan, and low collection rate. Thus, it was recommended that the Malaysian

government should review these issues and design more effective and efficient

means of ensuring that sustainability is created through improved cost-recovery

mechanism.

In

conclusion, it has to be stated that the Malaysian government and governments

of other countries should never neglect the importance of making education

highly accessible in their country because, it helps in development of human

capital which will directly influence productivity and economic growth in the

country positively. It also has to be stated that loans should be chosen as the

preferred option for such support in place of grants and scholarships because

it makes funds highly available to all qualified individuals which is better

than the selective mechanism adopted by grants and scholarships.

6 REFERENCES

Aafaq (2007), “Plan for future

higher education in the Kingdom of Saudi Arabia”, working paper, Dhahran, May.

Alphonse, S. (2012), “Funding

Higher Education in Rwanda through Loans or Grants: efficiency and equity

arguments.” Research Note, pp. 1-8.

Altbach, P.G. (2004), Higher

Education Crosses Borderrs, TheJohns Hopkins University Press, Baltimore, MD.

Barr, N. A. & Crawford, I.

(2005) Financing higher education: answers from the UK. London: Routledge.

Barro, R.J. (1991), “Economic

growth in a cross section of countries”, Quarterly Journal of Economics, Vol.

106, pp. 407-43.

Barro, R.J. & Lee, J.W. (1994),

“Sources of economic growth”, Carnegie-Rochester Conference Series on Public

Policy, Vol. 40, pp. 1-46.

Blundell, R., Dearden, L., Goodman,

A. & Reed, H. (2000), “The returns to higher education in Britain: evidence

from a British cohort”, Journal of Economics, Vol. 110, pp. 82-99.

Gupta, A. (2008), “International

trends and private higher education in India”, International Journal of

Education Management, Vol. 22 No. 6, pp. 565-94.

Hassan, A. (2002), “Current

practices of Malaysia higher education”, paper presented at the International

Forum: “Globalization and Integration in higher education”, University Sainsand

Teknologi Malaysia, Petaling Jaya.

Hauptman (2003), Reforming the Ways

in Which States Finance Higher Education, The Johns Hopkins University Press,

Baltimore, MD, p. 64.

Karmokolias, Y. & Maas, J.V.L.

(1997), The Business of Education: A Look at Kenya’s Private Education Sector,

The World Bank, Washington, DC.

Lindong, L.A. (2007), “A cross-case

study of the competitive advantage of private higher educational institutions

in Kuching, Sarawak”, PhD thesis, University of Sains Malaysia, Penang.

Marjik, C.V. (2003), “Globalisation

and access to higher education”, Journal of Studies in International Education,

Vol. 7 No. 193, pp. 1-15.

Maureen, W. (2004), “Student Loans:

Potential, Problems, and Lessons from International Experience”. JHEA/RESA Vol.

2, No. 2, 2004, pp.37–51

Middlehurst, R. &Woodfield, S.

(2004), Transnational, Private and For-Profit Education: Mapping, Regulation

and Impact, Final Research Report to UNESCO and COL, UNESCO, Paris, available

at: http://portal.unesco.org/education.en/ev.php-URL_ID¼22114&URL_ DO¼DO_TOPIC&URL_SECTION¼201.html

(accessed October 20, 2008).

Morgan-Klein, B. & Murphy, M.

(2002), “Access and recruitment: institutional policy in widening

participation”, in Trowler, P. (Ed.), Higher Education Policy and Institutional

Change, The Society for Research into Higher Education and Open University

Press, Buckingham.

Olaniyan, D.A. &Okemakinde, T.

(2008), “Human capital theory: implications for educational development”,

European Journal of Scientific Research, Vol. 24 No. 2, pp. 157-62.

Patrinos, H. (2000), “The global

market for education”, paper presented at the AUCC International Conference,

Montreal, 31 October-2 November 2000, available at: www. worldbank.org/edinvest

(accessed November 21, 2008).

Psacharopoulos, G. &Woodhall,

M. (1997), Education for Development: An Analysis of Investment Choice, New

York Oxford University Press, New York, NY.

PTPTN (2013), “Loan Repayment.”

Available at: http://www.ptptn.gov.my/web/english/loan-repayment

[Accessed on: 11-02-2013].

Rebelo, S. (1991), “Long-run policy

analysis and long-run growth”, Journal of Political Economy, Vol. 99, pp.

500-21.

Refa.Org (2013), “The PTPTN

Dilemma.” Available at: http://refsa.org/wp/wp-content/uploads/2013/01/Infographic-5-The-PTPTN-Dilemma1.pdf

[Accessed on: 11/02/2013].

Sakamota, A. & Powers, P.A.

(1995), “Education and the dual labour market for Japanese men”, American

Sociological Review, Vol. 60 No. 2, pp. 222-46.

Samuel Jebaraj Benjamin, M.

SrikamaladeviMarathamuthu, SaravananMuthaiyah, Murali Raman, (2011),"Affordability

of private tertiary education: a Malaysian study", International Journal

of Social Economics, Vol. 38 Iss: 4 pp. 382 – 406

Schultz, T.W. (1971), Investment in

Human Capital, The Free Press, New York, NY.

UNESCO (2006), From Global

Education Digest, UNESCO-UIS, Montreal.

Woodhall, M. (1987a) Lending for

learning: designing a student loan programme for developing countries. London:

Commonwealth Secretariat.

Woodhall, M. (1987b) Establishing

student loans in developing countries: some guidelines. New York: World Bank.

Woodhall, M. & Barr, N. A.

(1989) Financial support for students: grants, loans or graduate tax? London:

Kogan Page with the Institute of Education University of London.

World Bank. (1986). Financing

education in developing countries: An exploration of policy options. Washington

DC: World Bank.

World Bank. (1994). Higher

Education: The lessons of experience. Washington, DC: World Bank.

World Bank (2000), Higher Education

in Developing Countries: Peril and Promise, The World Bank, Washington, DC.

Yahaya,M. & Abdullah, I.H.

(2003), “Challenges of corporatization and globalization: educational reform in

tertiary education”, paper presented at the 4th Biennial Comparative Education Society

of Asia Conference, 21-22 July, UniversitasPendidikan Indonesia, Bandung.